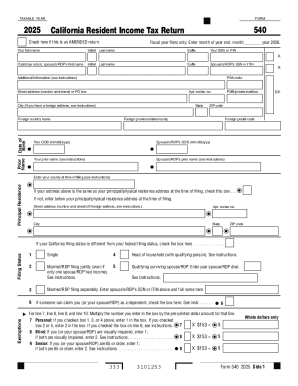

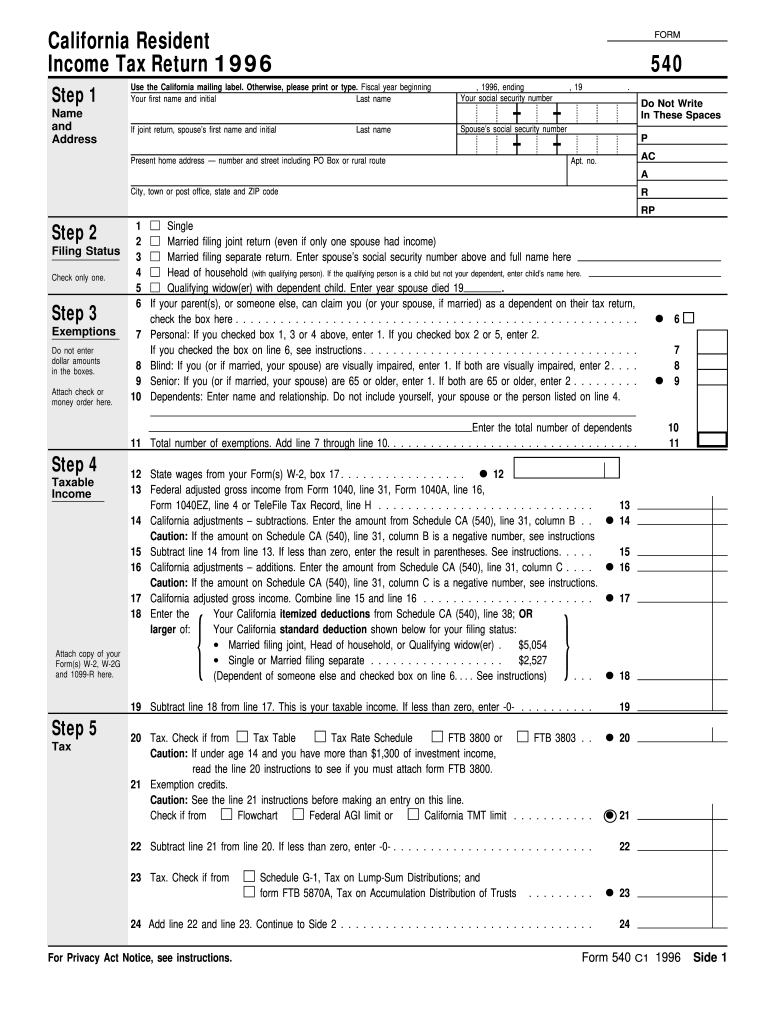

CA FTB 540 1996 free printable template

Instructions and Help about CA FTB 540

How to edit CA FTB 540

How to fill out CA FTB 540

About CA FTB previous version

What is CA FTB 540?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

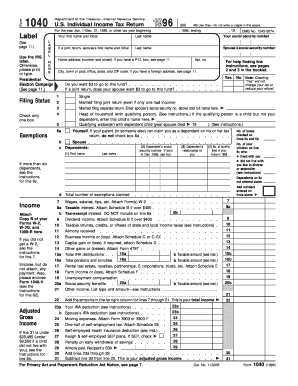

FAQ about CA FTB 540

What should I do if I made a mistake on my CA FTB 540 after filing?

If you discover an error after submitting your CA FTB 540, you can file an amended return using Form 540-X. This form allows you to correct mistakes related to your income, deductions, or credits. It's important to file the amended return as soon as you identify the error to minimize any potential penalties or interest.

How can I check the status of my CA FTB 540 submission?

To verify the status of your CA FTB 540 submission, you can visit the California Franchise Tax Board's website and use their online status tool. You will need to provide your Social Security number and the amount of your expected refund or balance due to access your filing status.

What privacy measures does the CA FTB take to protect my information?

The California Franchise Tax Board employs various privacy and data security measures to protect taxpayer information. This includes encryption technologies, secure server protocols, and strict access controls to ensure your personal data remains confidential and secure throughout the filing process.

See what our users say